philadelphia property tax rate 2022

Only property owners whose values change will receive notifications. Tax Year 2022 assessments will be certified by OPA by March 31 2021.

.jpg)

Pa State Rep Property Taxes Time To Eliminate

The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

. Philadelphia Property Taxes Range. An office building worth 50 million has the same 13998 property tax rate as a home worth 50000. Ultimate Philadelphia Real Property Tax Guide for 2022.

Philadelphia Property Taxes Range. If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT. Philadelphia property assessments wont change much in 2021 after city scraps revaluation plans Property owners will not receive notices of new values this spring.

While the citys property tax rate has not changed in the last few years some property owners have had significant tax increases due to changing assessments. Help is also available to veterans. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment OPA.

Instead their 2020 values will also be used to calculate tax bills in 2021. Property tax in Philadelphia County is calculated by multiplying the taxable value with the corresponding tax rates and is an estimate of what an owner not benefiting from tax exemptions would pay. Reporter Philadelphia Business Journal.

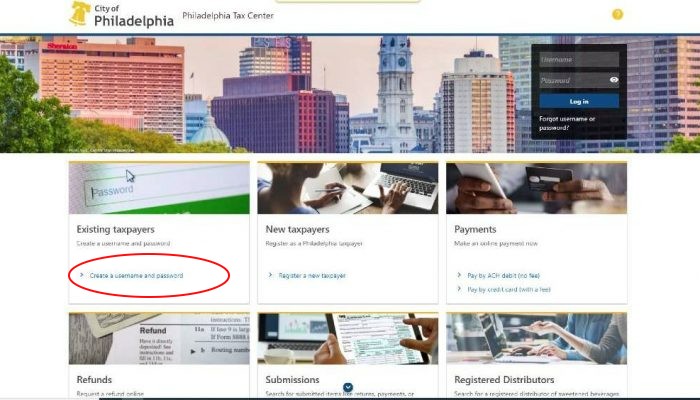

Philadelphia has a robust economy with strong ties to the food education and healthcare industries. You can also generate address listings near a property or within an area of interest. Use the Property App to get information about a propertys ownership sales history value and physical characteristics.

091 of home value. The City of Philadelphia has announced that due to operational concerns caused by the COVID-19 pandemic it will forego a citywide reassessment of all property values for tax year 2022. Tax Development Apr 22 2022.

The city of Philadelphia is expected to begin issuing 2023 real estate tax assessment values later this month after pausing the practice from 2020 to 2022 because of disruptions from the pandemic. Guide To Pa Property Taxes Psecu You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia. Between 2018 and 2019 the median property value increased from 167700 to 183200 a 924 increase.

Residents making 100 an hour have the same 38398 wage tax rate as those making the 725 minimum wage. Bills reflecting those assessments will be issued in December 2021 for taxes due in. Report a change to lot lines for your property taxes How to report a change in property divisions to the Office of Property Assessment.

Yearly median tax in Philadelphia County. There is a general property tax rate of 13998 for the whole county comprised of 06317 allocated to the city and 07681 allocated to schools. Ultimate Philadelphia Real Property Tax Guide for 2022.

For the 2022 tax year the rates are. Rates due dates discounts and exemptions for the Citys Real Estate Tax which must be paid by owners of property in Philadelphia. Philadelphia property tax rate 2022 Friday March 18 2022 Edit.

Philadelphia Announces Fiscal Budget and Real Estate Reassessment for Tax Year 2023. Search and Pay your Real Estate Taxes. Average Property Tax Rate in Philadelphia.

Philadelphia property tax rate 2019 Monday February 28 2022 Edit. Mayor Jim Kenneys administration isnt reassessing all properties for tax years 2021 or 2022 instead giving the citys Office of Property Assessment time to implement a long-awaited new computer system make. The City of Philadelphia will skip property tax reassessments for the 2022 tax year due to Covid-19 operational issues.

Reading this guide youll obtain a good insight into real property taxes in Philadelphia and what you should take into. Overview of the Philadelphia Real Estate Market 2022. Bills reflecting those assessments will be issued in December of 2021 for taxes due in March of 2022.

Our Installment program is also helping seniors and low-income families pay their bills in monthly installments. But you must act fast as March 31 is also the deadline to apply for the 2022 Real Estate Installment Plan. The last citywide reassessment was for tax year 2020 based on values the Office of Property Assessment certified on or before March 31 2019.

Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax. People in philadelphia county pa have an average commute time of 325 minutes and they drove alone to work. Those property owners will receive notice of their assessments by March 31 and their new values will take effect for taxes in 2022.

Just call 215 686-6442 and ask about our Real Estate Tax relief. Philadelphia property tax rate 2019. Different rates for various types of property though commonplace elsewhere are prohibited.

Pennsylvania is ranked 1120th of the 3143 counties in the United States. By Kennedy Rose. Who pays the tax Anyone who owns a taxable property in Philadelphia is responsible for paying Real Estate Tax.

Philadelphia property tax rate 2019. Philadelphia property owners are enjoying a two-year reprieve from reassessments and the tax hikes that often follow. Philadelphia is the sixth-most populous city in the United States with over 15 million people residing there.

Real Estate Living On Twitter Real Estate Tips Real Estate Infographic Real Estate Agent Mean Elevation Of Each State In The U S Oc 2300x1500 Illustrated Map Usa Map Historical Geography. Philadelphia property owners will not have their home values reassessed until 2022 with some exceptions. Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than the local income tax paid by residents.

Philadelphia PA 19105. Based on latest data from the US Census Bureau. Typically the owner of a property must pay the real estate taxes.

City Council Members Call For Wealth Tax In Philadelphia Local News Phillytrib Com

Philadelphia Cost Of Living 2022 Can You Afford Philadelphia Data

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Philadelphia County Pa Property Tax Search And Records Propertyshark

Pennsylvania Property Tax H R Block

Philadelphia County Pa Property Tax Search And Records Propertyshark

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia

Philadelphia County Pa Property Tax Search And Records Propertyshark

U S Sen Elizabeth Warren Pitches A Philadelphia Wealth Tax Ahead Of Mayor Kenney S Budget Proposal

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

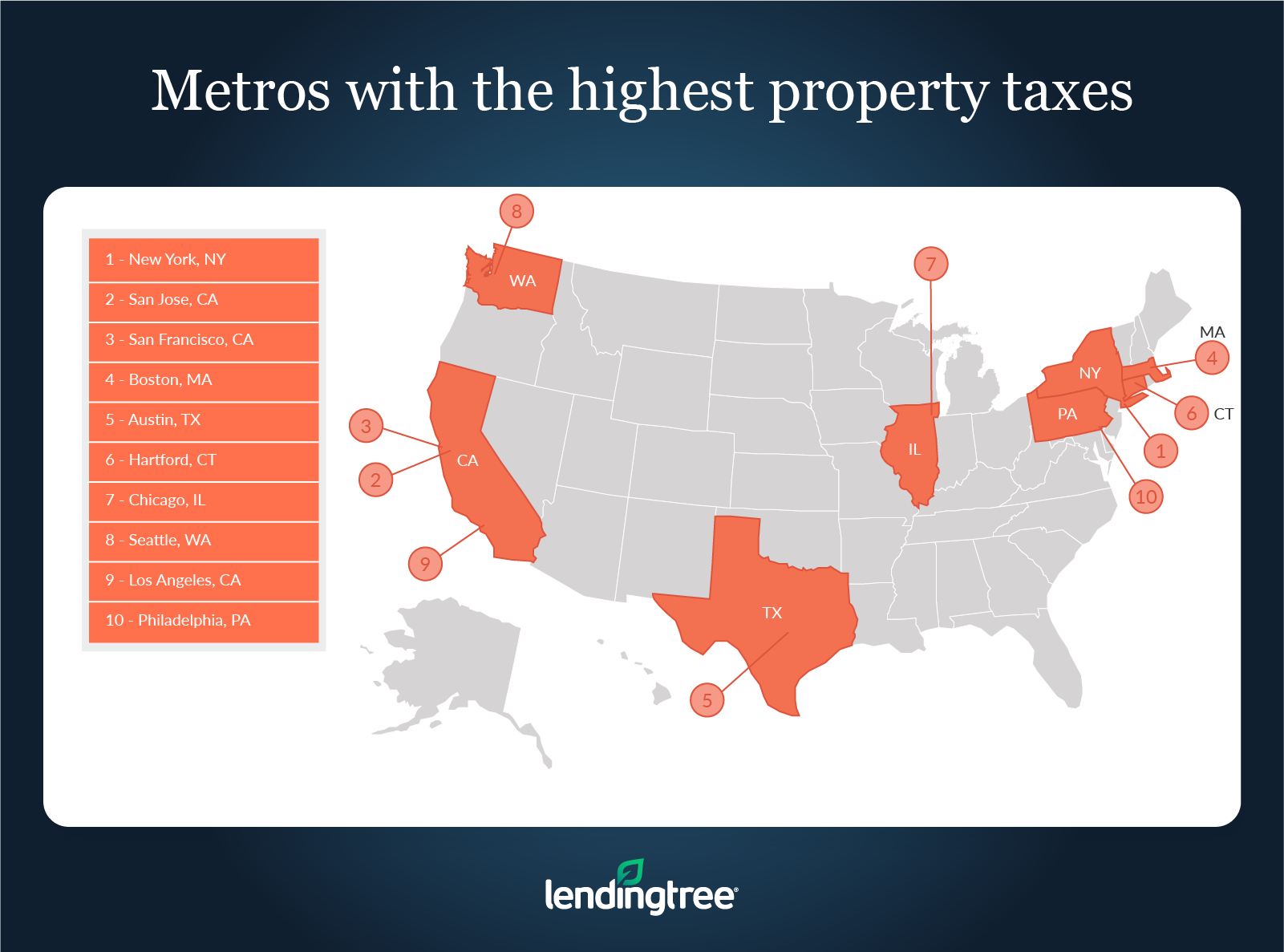

Where People Pay Lowest Highest Property Taxes Lendingtree

Socked By The Pandemic Kenney Administration Forgoes Property Reassessments For Second Year In A Row Pennsylvania Capital Star

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

Philadelphia County Pa Property Tax Search And Records Propertyshark